omaha ne sales tax calculator

Nebraska has a 55 statewide sales tax rate but also has 295. The Nebraska state sales and use tax rate is 55 055.

Sales Taxes In The United States Wikiwand

Taxes-Consultants Representatives Tax.

. The current total local sales tax rate in Omaha NE is 7000. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. RE trans fee on median.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription. The latest sales tax rates for cities starting with A in Nebraska NE state. Long- and short-term capital gains are included as regular income on your Nebraska income tax return.

Sales tax in Omaha Nebraska is currently 7. The Registration Fees are assessed. The sales tax rate for Omaha was updated for the 2020 tax year this is the current sales tax rate we are using in the Omaha Nebraska Sales Tax.

Real property tax on median home. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

Just enter the five-digit zip. The minimum combined 2022 sales tax rate for Omaha Nebraska is. Sales Tax State Local Sales Tax on Food.

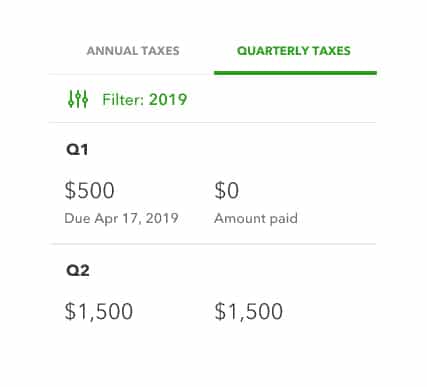

The calculator will show you the total sales tax amount as well as the county city. This is the total of state county and city sales tax rates. How Does Sales Tax in Omaha compare to the rest of Nebraska.

Are Dental Implants Tax. The December 2020 total local sales tax rate was also 7000. Opry Mills Breakfast Restaurants.

The Nebraska NE state sales tax rate is currently 55. MINI of Omaha Sales. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

Omaha Ne Sales Tax Calculator. The Nebraska sales tax rate is currently. Nebraska Capital Gains Tax.

Omaha Ne Sales Tax Calculator. Restaurants In Matthews Nc That Deliver. The average cumulative sales tax rate in Nemaha Nebraska is 55.

Sales Tax Calculator in Omaha NE. Taxes-Consultants Representatives Tax Return. 2020 rates included for use while preparing your income.

Nemaha is located within. Rates include state county and city taxes. That means they are taxed at the rates.

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. Sales Tax State Local Sales Tax on Food. 1500 - Registration fee for passenger and leased vehicles.

Free Unlimited Searches Try Now. This includes the rates on the state county city and special levels. Name A - Z Sponsored Links.

Nebraska sales tax details. Real property tax on median home. Free Unlimited Searches Try Now.

You can find more tax rates and. Registration fee for commercial truck and truck tractors is based. You can find more tax rates and allowances for Omaha and Nebraska in the 2022 Nebraska Tax Tables.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Today Nebraskas income tax rates range from 246 to 684 with a number of deductions and credits that lower the overall tax burden for many taxpayersContact Us. Ad Get Nebraska Tax Rate By Zip.

Ad Get Nebraska Tax Rate By Zip. Sales Tax Calculator in Omaha NE. Name A - Z Sponsored Links.

Credit Karma To Offer Tax Filing Through Turbotax Forbes Advisor

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Item Price 29 99 Tax Rate 6 25 Sales Tax Calculator

Nebraska Income Tax Calculator Smartasset

Nebraska Sales Tax Rates By City County 2022

Quickbooks Self Employed Review Features Pricing In 2022

Taxable Social Security Calculator

Nebraska Sales Tax Small Business Guide Truic

Sales Tax Tax Calculations Omaha Ne

Nebraska Income Tax Calculator Smartasset

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Which States Require Sales Tax On Clothing Taxjar